TKO Group, the combat sports giant formed out of the merger of the Ultimate Fighting Championship (UFC) and World Wrestling Entertainment (WWE) promotions, has announced record revenue and sponsorship deals for 2023.

TKO announced annual results of $1.7 billion, which consists of UFC’s full year and WWE’s results from September 12 – the day WWE was merged with UFC to form TKO.

Overall, the UFC produced $1.3 billion in revenue – a 13% increase from 2022. In the fourth quarter alone, the MMA promotion earned $282.8 million in revenue, up from $271.1 million during the same time the previous year.

The company said the revenue jump came from a $76.2 million increase in media rights and content fees, a $42.6 million rise in live events income, and a $29.5 million increase in sponsorship revenue.

The biggest increase for the UFC came via live event revenue, which jumped 34% to a record $168 million in 2023 with 34 events in the year. The rise was generated by ticket sales and site fees.

Record sponsorship income also contributed to the high figure, jumping 18% to $196 million. It will likely increase more next year on the back of the promotion securing a lucrative multi-year deal with drinks giant Anheuser-Busch and its beer brand Bud Light.

Media rights continued as the biggest driver of increased revenue for UFC, with $870.6 million for the year – up from $794.4 million in 2022 on the back of UFC’s partnership with international sports broadcaster ESPN.

On the WWE side, TKO said the division generated a total revenue of $331.2 million for the fourth quarter – two-thirds of which came from media rights.

Attendance to WWE events jumped 34% for the full year, while each premium event aired on broadcast partner Peacock set viewership records, with average viewership and hours watched jumping 25% and 22%, respectively.

TKO has not merged WWE’s pre-merger financials into its report for the year, so there is no direct official comparable financial period for WWE in the latest report. Last year, WWE posted fourth-quarter sales of $324.3 million.

Looking ahead to 2024, TKO said it is targeting revenue for the year at between $2.58 billion and $2.65 billion for the combined companies at UFC and WWE.

In a statement, TKO chief executive Ari Emanuel said: “TKO is off to a strong start following record financial performance in 2023 at both UFC and WWE.

“We secured Anheuser-Busch as the official beer partner of UFC, delivered a transformative deal to bring WWE’s Raw to Netflix beginning in 2025, and expanded our international footprint in important growth markets.”

Media rights for TKO are set to skyrocket further after WWE inked a 10-year, $5 billion deal to take WWE Raw to streaming platform Netflix starting in 2025, as well as a separate broadcasting deal to take Smackdown to the USA Network.

Negotiations for a new UFC rights deal are due to start this year, with its contract with ESPN coming to an end in 2025.

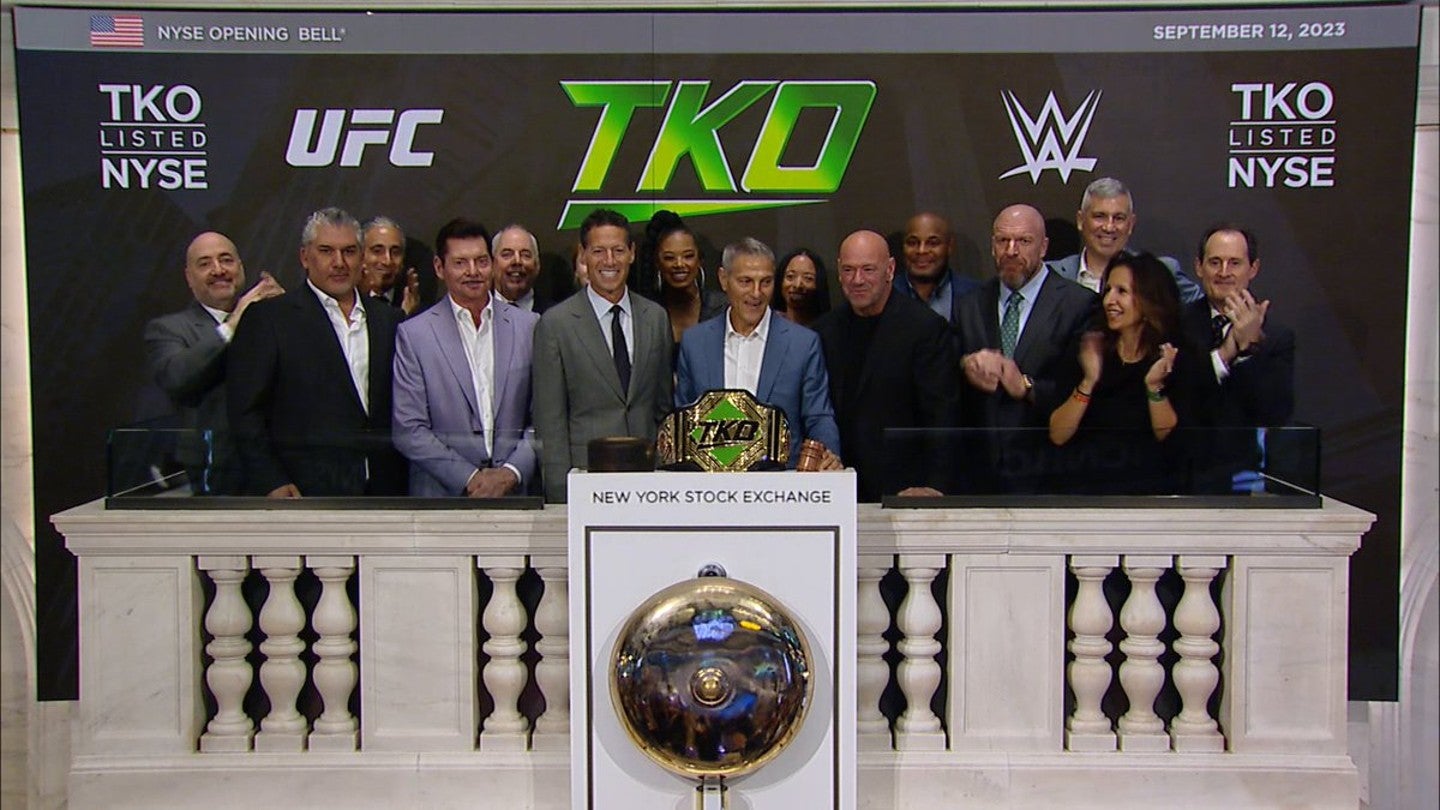

Endeavor, the international entertainment and sports giant, completed its deal with WWE to merge the organization with UFC under the TKO Group name last September.

Combined, TKO boasts more than 1 billion fans worldwide, reaching viewers in 180 countries, and producing more than 350 annual live events.

In recent years, UFC has partnered with major brands including Anheuser-Busch, Crypto.com, DraftKings, Jose Cuervo, Monster Energy, Prime Hydration, Timex, and VeChain.

In addition, WWE has worked with many blue-chip brands and over the last year has teamed up with Applebee’s, General Mills, Mattel, Netflix, PepsiCo, Pizza Hut, Slim Jim, and Snickers.