Last December, sports data and technology firm Sportradar unveiled a long-term partnership with Tennis Data Innovations (TDI), a joint venture between the ATP, organizer of the top-tier men's tennis tour, and its ATP Media commercial body.

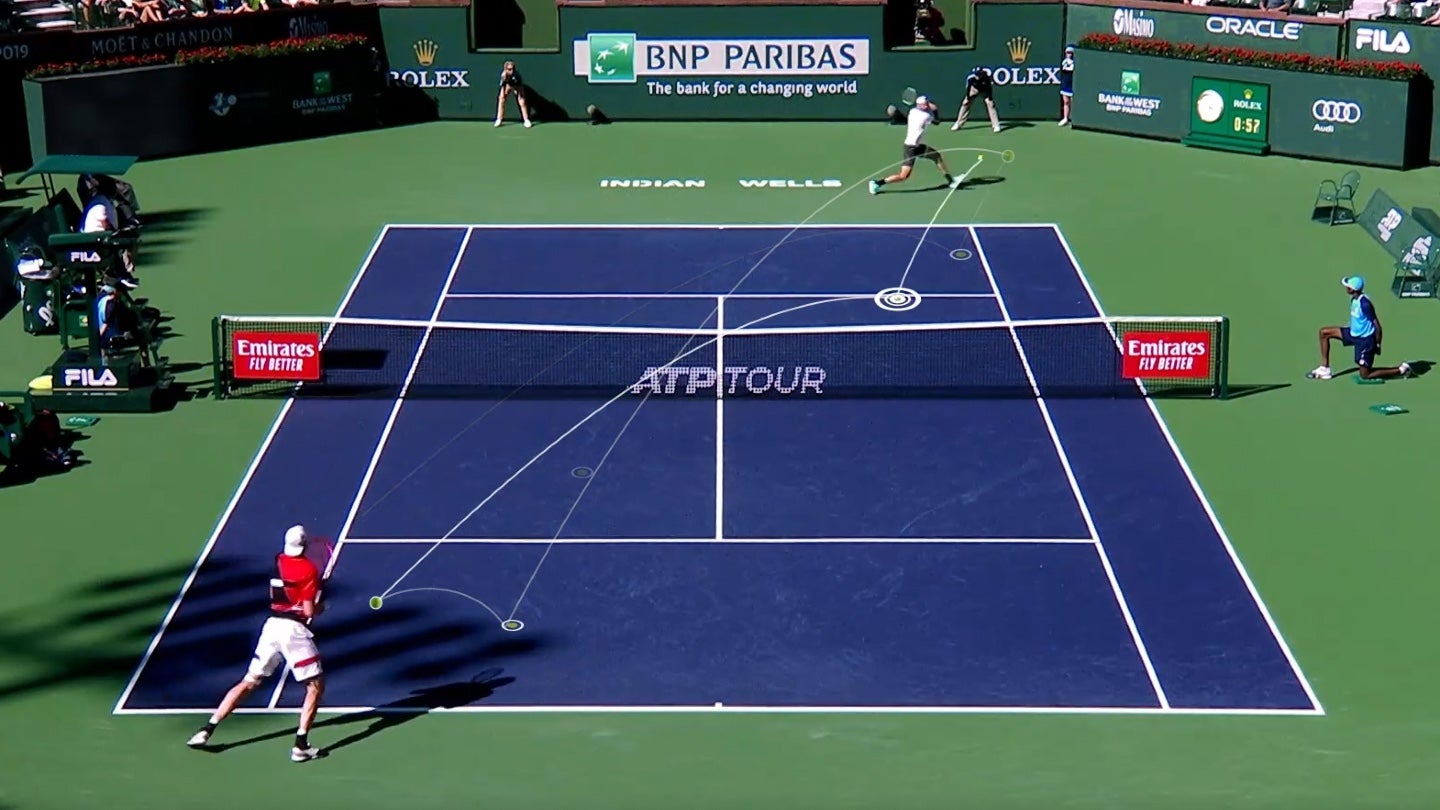

One of the most prominent results of that tie-up has been the launch of Sportradar 4Sight, a technology solution that enables the appearance of high-speed, high-detail data as on-screen animations and graphics.

This solution, which went live in March (around the initial ATP 1000 event of the year at Indian Wells in California), aims to revolutionize the world of sports betting by offering an array of new data points and statistics to fans watching via live-streaming options offered through sportsbooks.

These overlays - with typically no more than two shown on-screen at any one time - are available to sportsbooks that have streaming deals in place with the ATP for coverage of the tour.

They are filmed through specific cameras at each match, which remain fixed on the court itself at all times. Artificial Intelligence - reacting to the match event - is then triggered to transform the data into on-screen graphics.

The project is being overseen by Patrick Mostboeck, Sportradar’s senior vice president of fan engagement, who has been in charge of the initial 4Sight roll-out since the beginning of 2024.

Following the first three months of the ATP rolling out 4Sight to its sportsbook partners, and with the ATP Tour now swinging through the iconic Queen’s Club Championships in London, he spoke to Sportcal (GlobalData) regarding the technology’s overall purpose, how it will alter fan engagement, and which sports properties might be able to implement it next.

Mostboeck, who has been at Sportradar since July 2016 and has headed up the firm’s fan engagement division since January, starts by explaining the general idea behind 4Sight.

This solution, he says, “is an augmented streaming product, one of our key pillars in elevating the game. We’re essentially using the deep data collected via TDI from all ATP events and visualizing it on the stream.

“Our objectives are to provide a better understanding of the action, to help new fans get into the game, to help them understand why a certain player is winning or losing.

“Our joint vision is to use the mass of micro-events and data available within tennis to develop new stand-out markets for betting. These new markets will only be possible if they are visually represented in a meaningful way.

“We’re looking to give visual representation to a lot of different events across tennis - and then see which of those are developing the best traction, and which we can look to commercialize this into new and emerging betting markets.”

He adds that more rights holders, not just the ATP, are recognizing the need to add extra data and information to their broadcasts - whether for betting operators or for regular consumption of sporting events.

Statistics available through 4Sight include data points such as serve speed, and the number of shots per rally.

The graphics are visualizations that are related to specific match events - for example, after a tennis ace, a graphic will be shown featuring the event name, the speed of serve, and the number of total aces by that player.

The technology involved, while capable of showing any number of animations on-screen simultaneously, is only used for one or two concurrently, as any more would - Sportradar feel - be distracting to the viewer.

In terms of how betting operators are choosing to deploy this new array of options, many have now placed it as a secondary option on their main live-streaming page for ATP events.

Mostboeck explains: “Operators are typically integrating 4Sight as a second feed behind their main streaming feed - usually in the video player they have on their site, you can switch between a traditional streaming experience and one with the augmented 4Sight experience.

“They typically implement it as an option on the menu, but a few completely rely on it. Most operators offer both - for them, it’s a gradual decision [in terms of implementing new technologies] as tennis is normally a major sport in terms of betting operators.

“Change does not come rapidly, but we’re trying to equip rightsholders with the necessary tools and tech, and help them walk along that path.”

In terms of other ways aside from sports betting in which 4Sight could be used - it is currently only available for sportsbooks but there are plans for that to change - Sportradar sees several options as possibilities.

While the company “always thinks betting-first,” Mostboeck says, he also believes the technology could be used for simple broadcast use.

He explains: “The solution can be used to create output for a media product as opposed to a betting product - for example, we’re discussing with ATP Media and other subsidiaries how to use this for sponsorship purposes. This could involve using augmentation to enhance sponsors’ rights through this experience.

“For tours like the ATP Challenger Tour, with a significant volume of events, further commercialization through sponsors is an interesting angle to consider in terms of future uses for 4Sight.”

The product was actually first implemented across table tennis in late October, and Mostboeck explains that several learnings were taken from this initial rollout.

He says: “The first sport we used for 4Sight was table tennis - one of the main learnings was that you can actually do too much with data. When we started we developed so many different augmentations that the screen became filled and the viewers' eyes could not take in all that was being offered from a graphics perspective.

“We took the learning of crafting an experience for the end customer that is not overwhelming - while we want to showcase what is possible, the user only wants a certain amount to be visible.

“The clear priority for us is what is important and a primary experience to the end user … From their point of view, everyone is seeking simplicity.

“What we’ll end up developing is different experiences for different target groups - we’re investing in the base layer of tech at the moment, which will remain the same whatever output it requires. The technical requirements don’t change. Doing this groundwork is a key step - no matter whether the output shows five graphics or 20, and regardless of what they say, the technical workflow is the same.”

He adds that throughout the ATP-TDI partnership, Sportradar has been adding new metrics to its on-screen graphics during live-streaming broadcasts, and also “replacing ones which we initially put in, but then didn’t move the needle - let’s put other metrics in instead, which can drive more interest.

“All this tech we develop - it’s only relevant if it creates adoption in the market and also drives additional value. If this is not happening, what’s the point?”

Beyond the ATP-TDI partnership, Sportradar’s roadmap for the development of 4Sight involves aiming to branch it out across basketball, soccer, and other tennis properties.

He explains that these sports are the way forward initially “because there are where the highest values sit and also where some of our largest partnerships are, with the likes of the NBA and the [German men’s soccer] Bundesliga.”

A tie-up with the NBA (including an equity stake) is in place until 2031, while the Bundesliga deal was recently extended and expanded through the league’s 2031-32 campaign.

Tennis and table tennis were the first sports selected due to their simplicity in terms of the on-screen action - having only two athletes, predominantly only moving from left to right and vice versa, differentiates those sports from team games.

Basketball will be onboarded sooner than soccer, Mostboeck explains - due partly to a much smaller playing area - whilst he adds that the eventual plan is to “explore all avenues … We’re very open to working in all types of directions - what’s important for us is offering enhanced viewing options and developing them into audience-specific experiences.

Moving to the subject of innovation levels within the sports rights sector as a whole, Mostboeck feels they have risen significantly within the last few years, as consumers and viewers - faced with significantly more choices and options - demand greater innovation to content.

He explains that Sportradar’s partners “understand that this is necessary for audience gathering, development, and monetization …

“Investing in your audience is what it’s all about for rightsholders,” he says.

The NBA, according to the Sportradar executive (and many other keen observers within the same space) is “setting the standard with innovation, regarding their strategies with their own content platforms, their strategies around new viewing experiences. A lot of other properties take an example from them, including in tennis and soccer. That plays well for us.”

He sums up the long-term plans for this latest example of Sportradar’s focus on innovation: “We hope that in coming years, there will be such a range of tech like this available so the end user can choose which stream to watch, and which options to select, which themed augmentations to toggle through.

“Our objective is to set up the tech in such a way that those user-driven experiences are possible.

“We’re offering a first wave now and we want to shift to a fully mature product, which would give stakeholders a whole suite of new options, both for audience engagement and monetization.”

It would be beneficial for the whole sector, he believes, if technology such as this “becomes a commoditized asset, using augmentation to develop the user experience across all types of audience groups - betting, media, young audiences, sporting experts.

“Adoption is key for us - we already have a handful of clients launched, but there’s still a lot of room for growth between who has it and who could potentially have rights to use it.”

Mostboeck cites one Italian client in particular, as having “reported success back to us openly, which is unusual.

“Once they use it, they see positive feedback from the user as well as good adoption rates.”