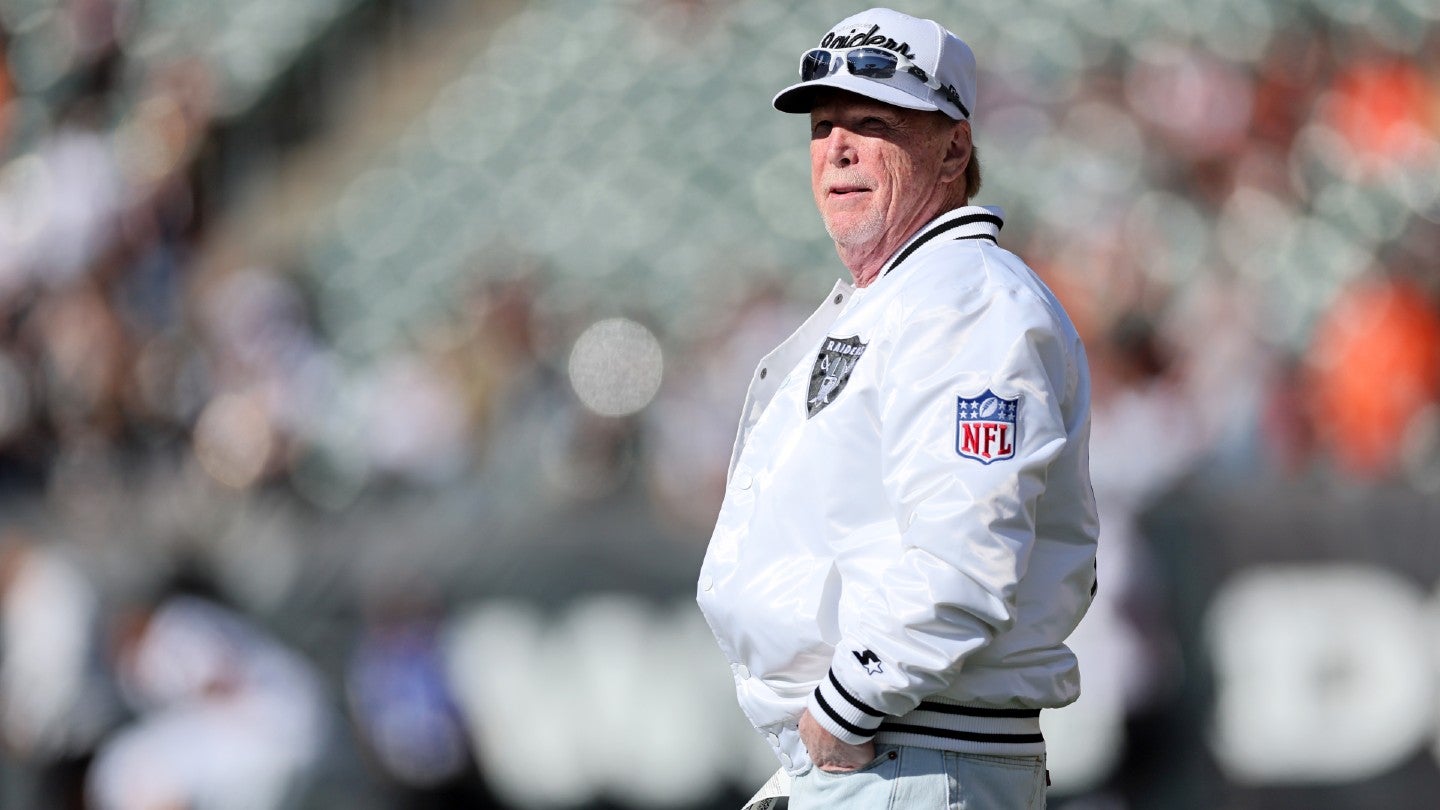

Mark Davis, the owner of the National Football League’s (NFL) Las Vegas Raiders franchise, is reportedly set to sell a 15% stake in the team.

The New York Times has reported today (November 21) that deals in principle have been reached with two separate bidders, each for 7.5% of the franchise - one from private equity firm Silver Lake co-chief executive Egon Durban, and the other from the Discovery Land real estate company founder Michael Meldman.

This deal could be approved as soon as December 10-11, 2024, when the next NFL owners meeting takes place, as the terms of the deal are already with the NFL’s finance committee for review.

Durban’s stake purchase in particular could have ramifications for the NFL as a whole, as it means Endeavor, the Silver Lake-owned sports giant that Durban chairs the board of, will have to divest from its WME Sports player representation arm in order to avoid a conflict of interest.

WME Sports represents, among other athletes, multiple NFL players, and current rules state that no NFL owner is allowed to represent players either individually or through their company.

Durban, however, has reportedly stated that Endeavor will divest itself from WME Sports within four months of the approval of his purchase, a promise that will be a topic of discussion for NFL owners at the meeting.

This would be the second time Davis has diluted his ownership stake this season, after he sold 10.5% of the Raiders to a group featuring NFL icon Tom Brady.

Brady and business partner Tom Wagner bought a combined 10%, while a further 0.5% went to former Raiders player Richard Seymour.

Brady and Wagner reportedly paid $220 million for 10% in the team, although that was reported to be a generous deal that gave the pair a large discount on the price, ostensibly due to their relationship and Brady's massive fame in the industry that would be expected to bring a boost to the franchise.

Brady is also part of Davis' Las Vegas Aces ownership group, having acquired a stake in the WNBA women’s basketball franchise in March.

As such, Durban and Meldman will likely each have to pay more than the aforementioned $220 million to secure their stakes.

Davis inherited the Raiders from his father Al in 2011.

Further stake sales in NFL franchises could be possible after the NFL approved private equity investment into the league.

The stake Davis inherited sat at around 47%, a controlling share at the time, but this latest sale could reduce that to 30.5%.

No matter how much Davis dilutes his stake, however, he will still remain in control over the Raiders, as NFL rules now state that owners who have controlled teams for over 10 years will retain that control even if they dilute their stakes down to the 1% level.

Owners such as Miami’s Stephen Ross and Terry Pegula of the Buffalo Bills are both in talks to sell minority stakes, capped at 10% with no controlling influence, to a few of the private equity firms approved for NFL investment.

Davis has seemingly not yet explored private equity investment, although it is clear he is not opposed to the further sale of his ownership.

The selected and approved private equity firms for NFL investment are: Arctos Partners, Ares Management Corporation, and Sixth Street, as well as a consortium of five funds — Blackstone, Carlyle, CVC, Dynasty Equity, and Ludis.

Alongside the 10% cap, other regulations include each purchase being held for a minimum of six years, each fund being able to invest in a maximum of six teams each, and no more than 20% of a fund being allocated to any one NFL franchise.

The league itself will also receive a percentage of the funds from each sale.

The Washington Commanders were the last NFL team to be officially sold, in mid-2023 to an ownership group led by billionaire Josh Harris, in a record-breaking deal valued at $6.05 billion. For that deal, over 20 investors were required to make up the equity cash necessary to buy the team.