The tussle over live sports coverage between streaming services and traditional TV networks has been intensified by the newly unveiled streaming platform from Fox Corp, Warner Bros. Discovery (WBD) and Disney.

By combining coverage rights to all major US sports, analysts say the new service is expected to accelerate ‘cord-cutting’ – the trend of consumers ditching pay-TV subscriptions for streaming services.

The three media giants say the service will target consumers “outside of the traditional TV bundle” when it launches around May, just in time for the start of the NFL and US college football.

The service, as yet unnamed, will include coverage from Disney’s ESPN, Fox Sports, and WBD-owned TNT Sport, as well as golf’s PGA Tour, mixed martial arts promotion UFC, and soccer’s FIFA World Cup.

“Pay-TV cord-cutting has been disastrous for US regional sports networks, whose business model relied upon fees from cable operators and traditional advertising,” says Tammy Parker, analyst at GlobalData. “National sports leagues are reaping the benefits from competing interests willing to pay astronomical fees to carry their programs. With Big Tech players like Amazon, Apple, and Google in the bidding fray, the sky is the limit for prices paid for the most high-profile sports content rights.”

In the hands of the sports leagues?

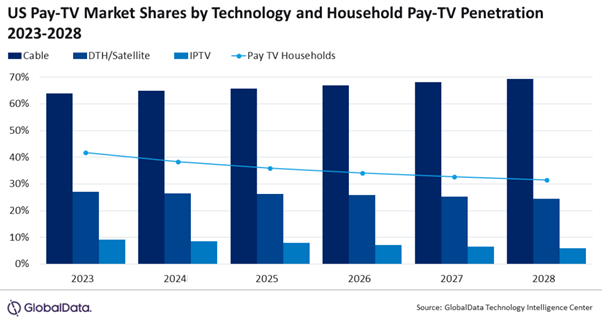

In the US, pay-TV household use continues to plummet.

Penetration exceeded 85% in the industry’s golden days of 2009 and 2010, but is projected to fall to around 32% in 2028, according to GlobalData’s United States Pay-TV Forecast report.

Given the increasingly expensive costs of cable TV bundles, many sports fans are questioning their worth if they are unable to view particular matches without subscribing to a separate, additional streaming service.

American football's Thursday Night Football, for example, is now exclusive to Amazon Prime TV in the US.

The recent NFL playoff game between the Miami Dolphins and Kansas City Chiefs aired solely on streaming service Peacock and NBC affiliates in Miami and Kansas City.

Whether or not streaming services supplant traditional cable networks remains in the hands of the sports leagues, according to Parker.

“Through contracts, the leagues dictate who gets the rights to carry live coverage and whether those rights include streaming”, Parker tells Sportcal. “The lure of younger, more affluent audiences is driving the migration of professional sports away from traditional broadcast and pay-TV networks and toward streaming platforms. Not only are those demographics appealing to advertisers, but those streaming audiences offer leagues many years of future loyalty.”

In some cases, streaming has already overtaken cable and satellite TV networks.

Google’s YouTube division in 2022 took exclusive rights to stream the NFL Sunday Ticket franchise to consumers in the US from satellite TV provider DirecTV.

There have been other instances of live sports available through both pay-TV providers and streaming apps, but the latter “may provide more affordable and targeted options to consumers, luring them away from traditional pay-TV”, according to Parker.

Free-to-air networks seek middle ground

On the same day as WBD, Fox and Disney unveiled their new platform (6 February), UK networks the BBC, ITV, Channel 4 and Channel 5 announced that their own planned live streaming service, Freely, will launch in Q2 this year.

This live streaming service from the UK’s largest free-to-air providers was first revealed in September amid controversy around rejigged English Premier League soccer TV rights.

GlobalData analyst Peter Scrimgeour believes the move is underpinned by traditional broadcasters’ linear channels losing viewers to streaming services.

“With traditional TV viewing in decline, cable TV providers losing subscribers, and intense competition from giant technology companies, these joint streaming services by legacy media are a reaction to an ever-changing television landscape and aim to futureproof their businesses with the huge shift towards streaming,” he tells Sportcal.

Amid the tumultuous battle between pay-TV giants and streaming services, free-to-air networks have identified a potentially beneficial middle ground.

Freely aims to consolidate the free-to-air broadcasters’ coverage of soccer's FIFA World Cup, the Olympic Games, the Wimbledon tennis grand slam, and other international competitions - but it will not attempt to compete with multibillion-dollar bids from the likes of Sky and NBC.

“It’s intriguing what Freely is doing, as we see a bit of a divergence here in the US,” Parker concludes. “Many people who subscribe to streaming video services are adding digital antennas to their houses to pick up free broadcast TV, often to watch their local news and sports teams on local broadcast affiliates.”