The Hundred was launched in 2021 to debut a new 100-ball format to global cricket. This initiative aimed to simplify the intricacies of the sport for newcomers, with a particular focus on the UK’s domestic sports audience.

Each ticket grants spectators admission to both the men’s and women’s matches, underscoring the tournament’s notable contribution to the advancement of women’s cricket with very positive attendances for women’s matches and many of the world’s best women’s cricket players competing in the competition.

Nevertheless, some critics maintain that the men’s segment of The Hundred has not yet achieved a significant presence on the global cricket scene. This is particularly evident when contrasted with other white-ball franchise tournaments, such as the IPL and SA20, which continue to attract the attention of both dedicated and casual cricket fans across the globe.

In May 2024, the English Cricket Board (ECB) announced its intention to launch a process through which investors could acquire stakes in the eight franchises of The Hundred. Nine months after this announcement, investor groups have commenced an eight-week exclusivity period to conclude their agreements for the respective teams.

A few major transactions include a consortium of technology magnates from Silicon Valley purchased a £145 million ($183.2 million) stake in the London Spirit. This group has secured a 49% interest in the team, which plays its home games at the prestigious Lord’s Cricket Ground.

The Leeds-based Northern Superchargers franchise was acquired by The Sun Group for £100 million, a 100% stake. The Sun Group owns the Indian Premier League team Sunrisers Hyderabad and Sunrisers Eastern Cape in South Africa’s T20 league.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataIn another significant development, the GMR Group, which owns IPL team the Delhi Capitals, has acquired a 49% stake in the Southern Brave during the auction process. This deal complements the GMR Group’s existing ownership of Hampshire County Cricket Club, which holds a 51% stake in the Southern Brave. Consequently, the Indian multinational conglomerate now holds a complete 100% stake in the franchise.

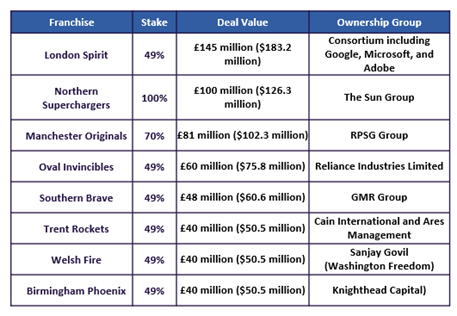

The accompanying table illustrates the sales prices for each Hundred franchise, detailing the respective stakes and ownership groups associated with each transaction.

Commercially, the evolution of The Hundred, which is now set to be driven by an array of Indian business tycoons, positions the competition to potentially emulate the SA20’s approach in securing sponsorship agreements with India-based brands.

The SA20, significantly influenced by the Board of Control for Cricket in India (BCCI) and the Indian Premier League (IPL), has established partnerships with Dream11, Zoho, and FanCraze, all companies with headquarters in India. Since 2021, The Hundred has entered into sponsorship agreements with two Indian brands – Dream11 and BKT.

Looking to the future, The Hundred may leverage its new Indian connections to develop commercial relationships with additional Indian brands. This strategy could prove pivotal in expanding the league’s sponsorship portfolio and maintaining its status as an attractive cricket competition for brand partnerships.

Vikram Banerjee, the ECB’s director of business operations, has described the expansion of the Hundred as a “no-brainer.” It is understood that numerous investors in the new teams view their involvement in The Hundred competition as a long-term commitment.

They anticipate the league will continue to flourish commercially and gain popularity on a global scale, building from strength to strength each year.

The entry of prominent investors linked to several of the world’s leading cricket franchises is anticipated to heavily influence the next domestic media rights cycle of The Hundred which is set to take place between 2029 and 2032. The value of international broadcasting agreements is projected to accelerate as the competition gains further recognition worldwide, especially in India.

At present, The Hundred is estimated to generate approximately £2 million from international broadcasters, a figure that is expected to increase substantially over the next decade.

The significant investment into the league should profoundly influence the financial landscape of English cricket. An allocation of £50 million has been earmarked for the sport’s recreational tier including the grassroots level, with the remaining funds being distributed among the 18 first-class counties and the owners of Lord’s, the Marylebone Cricket Club.

Counties that do not have a team participating in The Hundred will receive a more substantial portion of the funds. This fresh infusion of capital to each county team, particularly those lacking a Hundred franchise, will provide considerable relief to numerous counties that have been seeking financial respite following years of economic challenges, notably exacerbated by the COVID-19 pandemic.

In conclusion, the new investors in The Hundred are clearly convinced that this league has the potential to soar as one of the premier franchise cricket leagues globally. The ECB and the new team investors will be hoping the competition is now on an exciting new path that will sell out men’s and women’s games, with fans eager to witness some of the sport’s most illustrious figures competing to become The Hundred champions.

However, concerns persist regarding other facets of English cricket, including the future of the 20-over Vitality Blast—a tournament cherished by many English cricket enthusiasts—which now appears to have been relegated in the ECB’s list of priorities.

Only time will determine whether The Hundred will emerge as one of cricket’s major contests, but the ECB has unequivocally put considerable trust in the league’s new investors to actualize this vision.