US gambling sponsorship could be worth $475 million in six years’ time, and help to drive growth worldwide, following the relaxation of rules on sports betting in the country, according to Sportcal Sponsorship estimates.

An estimated 34 of the 50 states will have legalised sports wagering by 2024, and this will fuel significant expansion of a global betting brand sponsorship market presently valued at $674 million, of which USA contributes only around 10 per cent.

The potential has been unlocked by the ruling of the US

Supreme Court in May that the Professional And Amateur Sports Protection Act of

1992, which largely prohibited sports betting outside Nevada, was not

consistent with the US constitution.

The ruling has prompted various states and the country’s top sports leagues, governing bodies and teams to analyse how they might benefit from legalised markets.

Only last week, a Nielsen Sports report commissioned by the American Gaming Association predicted that the top four leagues stand to earn a combined $4.2 billion per year in extra revenue

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Company Profile – free sample

Company Profile – free sampleThank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData

Indeed, only last week, a Nielsen Sports report commissioned by the American Gaming Association, which represents the casino industry, predicted that the top four leagues stand to earn a combined $4.2 billion per year in extra revenue, as a result of the reforms.

The NFL leads the way with $2.3 billion, ahead of MLB with

$1.1 billion, the NBA with $585 million, and the NHL with $216 million.

The projected sums amount to additional income from media rights, television advertising, sponsorship, data and product revenue, ticket sales and merchandise, and this is without the 0.25-per-cent share of betting revenues that the leagues are seeking from casino groups and other operators as an ‘integrity fee’.

Five states – Delaware, Missouri, Nevada, New Jersey and West Virginia – have already passed laws allowing betting, and a further 13, led by New York, Pennsylvania and Rhode Island, have proposed legislation to follow suit.

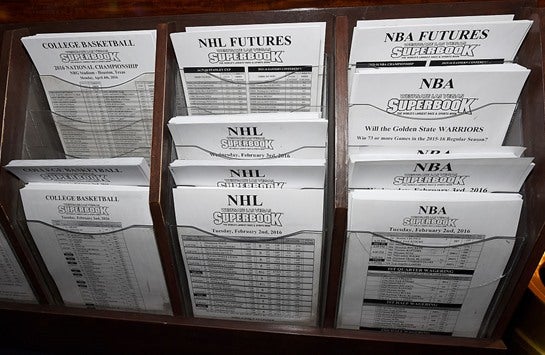

Having previously been resistant to betting, sports bodies have started to capitalise on the increased opportunities, with the NBA in August becoming the first major North American league to partner with a sportsbook operator in the shape of a multi-year deal with MGM Resorts.

Similarly, last month, the Vegas Golden Knights signed up

William Hill, the UK-based bookmaker, in what represented the first betting

sponsorship deal in the NHL.

Based on the existing partnerships of teams in the top four leagues, plus MLS, and with between 20 and 27 US states legalising sports betting, the related sponsorship market will be worth $232 million by 2020, according to Sportcal Sponsorship estimates.

That figure is expected to more than double, to $475

million, by 2024, as at least seven more states come on line.

By 2028, the betting sponsorship market is projected to be worth $810 million

By 2028, there could be as many 40 states where sports betting is permitted (Utah and Hawaii are likely exceptions), with the US sponsorship market projected to be worth $810 million at that stage.

The growth will be even more pronounced, with revenues

possibly hitting $1 billion, if at least one of the top leagues secures a

central betting sponsor.

Golf’s PGA Tour has ruled out, at least for now, having an official betting sponsor, and is wary, for integrity reasons, of its tournaments and players actively promoting companies from the sector.

However, it is looking at other ways in which it can achieve commercial and audience growth through the relaxation of gambling laws, for instance via the sale of data and increased engagement with fans.

Speaking at the recent Betting on Sports conference in London, David Miller, the tour’s vice-president and assistant general counsel, said: “US leagues historically banned gaming sponsorships and all are going through an evaluation of how and where they stand on this topic, and that includes the PGA Tour. It’s something that we’ve talked about at length and internally trying to work out what our policy is going forward, as sports betting is gaining in acceptance and is becoming legalised in the US.

“The NBA-MGM deal was really groundbreaking and I think you’ll see more and more deals of that nature. William Hill and the Vegas Golden Knights have announced a sports betting partnership. Those kind of deals will only become more and more prevalent.

“I don’t think advertising has really picked up yet… But I expect that to occur soon and we just want to make sure it’s done responsibly. I think the industry itself is invested in that as well and there are regulatory programmes being introduced by the AGA just to make sure that as sports betting increases in the US, advertising is done in a really responsible way.”

In a report in June, Gambling Compliance estimated that between 25 and 37 US states will have permitted sports betting by 2023, creating a market worth between $3.1 billion and $5.3 billion a year, and that, in the unlikely event of no further legalisation, it would still be worth $1.1 billion.

It added that although the more optimistic outlook “would account for just a small portion of the wider U.S. gaming industry in revenue terms, the repeal of PASPA means America is on track to become the largest sports betting market in the world within the next five years, surpassing the UK and potentially also China.”

However, the leagues face a challenge to get their hands on a share of this jackpot, with New Jersey among the states already allowing betting that have rejected the integrity fee, which was initially proposed to be as high as 1 per cent of betting revenues.

MLB, the NBA and the PGA Tour formed an informal coalition that has been liaising with federal and state legislators, other leagues and betting operators to devise workable structures.

However, speaking at a conference in July, NBA commissioner Adam Silver said: “Frankly, it’s not a place we’ve made a lot of progress. It’s one of the issues we’re talking to states about.”

Seeking to justify the integrity fee, Silver has pointed out that the league spends $7.5 billion per year providing content

Seeking to justify the integrity fee, he has pointed out that the league spends $7.5 billion per year providing content and “what will come with legalised sports betting are enormous additional expenses for the league that go directly to integrity.”

Speaking on a panel at this month’s Global Gaming Expo in Las Vegas, Kenny Gersh, the MLB’s executive vice-president of gaming, said that in the interests of “fairness,” the leagues should get a share of the proceeds.

He was quoted by AP saying: “The state is going to designate these three, four, five very specific licensed entities; you guys [the casinos] get the right to make money from sports betting.”

However, the argument was rejected by Sara Slane, the senior vice-president of public affairs at the AGA, who said: “You [the leagues] want a cut of the revenue without any of the risk that’s associated with it.

“That’s why we have to go through the regulatory process. We invest billions of dollars in buildings, in our licences that cost us millions of dollars to go through. You want us to take that risk, pay you and then you are going to benefit on the back end as well.”

She added: “What you guys are proposing is not financially viable.”

Conrad Wiacek, head of Sportcal Sponsorship, contributed to this article.